“The most significant economic event of the era since World War II is something that has not happened.”

Hyman Minsky, 1982

By Elham Saeidinezhad | In the 1945 film It’s A Wonderful Life, banker protagonist George Bailey (played by Jimmy Stewart) struggles to exchange his well-functioning loans for cash. He lacks convertibility—known as liquidity risk in modern finance—and so cannot pay impatient depositors. Like any traditional financial intermediary, Bailey seeks to transform short-term debts (deposits) into long-term assets (loans). In the eyes of traditional macroeconomics, a run on the bank could be prevented if Bailey had borrowed money from the Fed, and used the bank’s assets as collateral. In the late-nineteenth-century, British journalist Walter Bagehot argued that the Fed acts as a “lender of last resort,” injecting liquidity into the banking system. As long as a bank was perceived solvent, then, its access to the Fed’s credit facilities would be almost guaranteed. In an economy like the one in It’s A Wonderful Life, the primary question was whether people could get their money out in the case of a crisis. And for a long time, Bagehot’s rule, “lend freely, against good collateral, but at a high rate,” maintained the Fed’s control over the money market and helped end banking panics and systemic banking crises.

That control evaporated on September 15, 2008, with the collapse of Lehman Brothers. On that day, an enormous spike in interbank lending rates was caused not by a run on a bank, but by the failure of an illiquid securities dealer. This new generation of financial intermediaries were scarcely related to traditional counterparties—their lending model was riskier, and they did not accept deposits.1 Instead, these intermediaries synchronized their actions with central banks’ interest rate policies, buying more loans if monetary conditions were expansive and asking borrowers to repay loans if these conditions were contractive. They financed their operations in the wholesale money market, and most of their lending activities were to capital market investors rather than potential homeowners. When Lehman Brothers failed, domestic and foreign banks could no longer borrow in the money markets to pay creditors. The Fed soon realized that its lender of last resort activities were incapable of influencing the financial market.2 The crisis of 2008-09 called for measures beyond Bagehot’s principle. It revealed not only how partial our understanding of the contemporary financial system is, but how inadequate the tools we have available are for managing it.

Re-conceptualizing the Contemporary Financial System

Prior to the financial crisis, the emerging hybrid system of shadow banking went largely unmonitored. Shadow banking is a market-based credit system in which market-making activities replace traditional intermediation.3 A shadow banker acts more like a dealer who trades in new or outstanding securities to provide liquidity and set prices. In this system, short-term liquidity raised in the wholesale money market funds long-term capital market assets. The payment system reinforces this hybridity between the capital market and the money market. Investors use capital market assets as collateral to raise funds and make payments. The integrity of the payment system therefore depends on collateral acceptability in securities lending. Since the crisis, collateral has been criticized for rendering financial institutions vulnerable to firesales and loss of asset value. The Fed declined to save Lehman Brothers, a securities dealer, because the alternative would have encouraged others to make toxic loans, too. Like in Voltaire’s Candide, the head of a general was cut off to discourage the others.

The crisis also revealed the vulnerabilities of contemporary risk management. Modern risk management practices depend largely on hedging derivatives. Hedging is somewhat analogous to taking out an insurance policy; at its heart are derivatives dealers who act as counterparties and set prices. Derivatives, including options, swaps, futures, and forward contracts, reduce the risk of adverse price movements in underlying assets. The crisis exposed their fragile nature—dealers’ willingness to bear risk decreased following losses on their portfolios. These concerns left many firms frozen out of the market, forcing them to terminate or reduce their hedging programs. Rationing of hedging activity increased firms’ reliance on lines of credit. As liquidity was scarce, over-reliance on credit lines further strained firms’ risk management. In the meantime, rising hedging costs prevented them from hedging further. Derivatives dealers were essential players in setting these costs. During the crisis, dealers found it more expensive to finance their balance sheet activities and in return, they increased the fees. As a result of this cycle, firms were less and less able to use derivatives for managing risks.

Most financial economists analyze risk management through cash flow patterns. The timing of cash flow is critical because the value of most derivatives is adjusted daily to reflect their market value (they are mark-to-market). This requires a daily cash settlement process for all gains and losses to ensure that margin (collateral) requirements are being met. If the current market value causes the margin account to fall below its required level, the trader will be faced with a margin call. If the value of the derivatives falls at the end of the day, the margin account of the investors who have long positions in derivatives will be decreased. Conversely, an increase in value results in an increase in the investors’ margin account who hold the long positions. All of these activities involve cash flow.

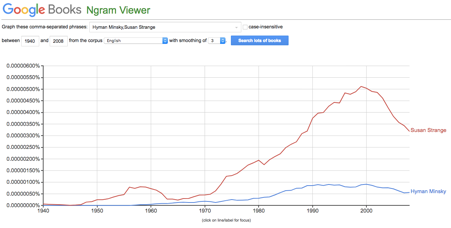

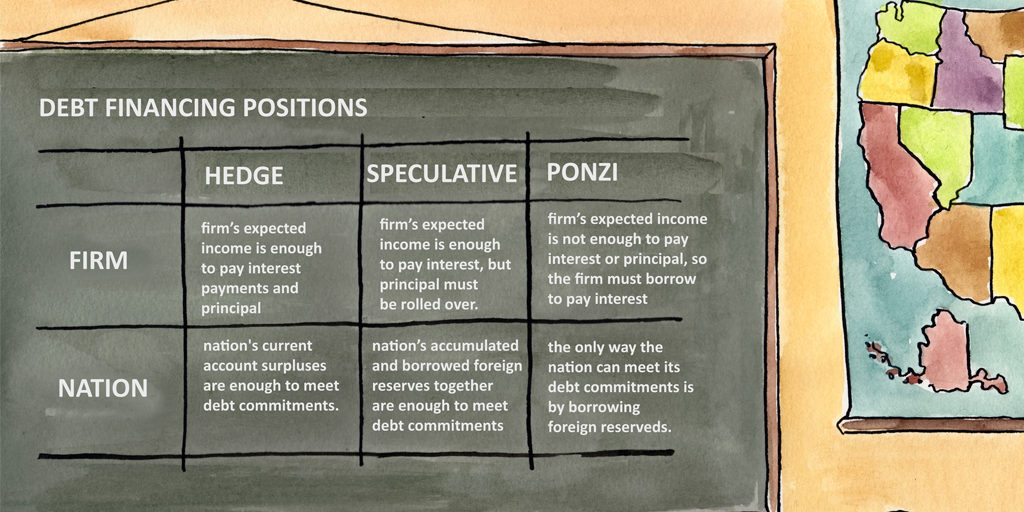

But in order to properly conceptualize the functioning of contemporary risk management practices, we need to follow in Hyman Minsky’s footsteps and look at business cycles.4 The standard macroeconomic framing begins from the position of a representative risk-averse investor. Because the investor is risk-averse, they neither buy nor sell in equilibrium, and consequently, there is no need to consider hedging and the resulting cash flow arrangements. By contrast, Minsky developed a taxonomy to rank corporate debt quality: hedge finance, speculative finance, and Ponzi finance. Hedge finance is associated with the quality of the debt in the economy and occurs when the cash from a firm’s operating activities is greater than the cash needed for its scheduled debt-servicing payments. A speculative firm’s income is sufficient to pay the interest, but it should borrow to pay the principal. A firm is Ponzi if its income is less than the amount needed to pay all interest on the due dates. The Ponzi firm must either increase its leverage or liquidate some of its assets to pay interest on time. Within this scheme, hedge finance represents the greatest degree of financial stability.

Minsky’s categorization scheme emphasizes the inherent instability of credit. In periods of economic euphoria, the quantity of debt increases because the lenders and investors become less risk-averse and more willing to make loans that had previously seemed too risky. During economic slowdowns, overall corporate profits decline, and many firms experience lower revenues.5 This opens the way for a “mania,” in which some in the hedge finance group move into speculative finance, and some firms that had been in speculative finance move into Ponzi finance.

Regulatory Responses to the Crisis: Identifying and Managing Risk

But why should a central banker worry about the market for hedging? After all, finance is inherently about embracing risk. In a financial crisis, however, these risks become systemic. Systemic risk is the possibility that an event at the company level could trigger the collapse of an entire industry or economy. Post-2008 regulatory efforts are therefore aimed at identifying systemic risk before it unravels.

The desire to identify the origins and nature of risks is as old as finance itself. 6 In his widely cited 1982 article , Fischer Black distinguished between the risks of complex instruments and the trades that reduce those risks—“hedges.”7 But less widely cited is his conviction that financial models, such as the capital asset pricing model (CAPM), are frequently not equipped to separate these risks.89

The same argument could be made for identifying systemic risk.10 To monitor systemic risk, the Fed and other regulators use central clearing, capital standards, and stress-testing. However, these practices are imperfect diagnostic tools. Indeed, clearinghouses may have become the single most significant weakness of the new financial architecture. In order to reduce credit risk and monitor systemic risk, clearinghouses ensure swaps by serving as a buyer to every seller and a seller to every buyer. However, they generally require a high degree of standardization, a process that remains poorly defined in practice. Done correctly, the focus on clearing standardized products will reduce risk; done incorrectly, it may concentrate risks and make them systemic. Standardization can undermine effective risk management if it constrains the ability of investors to modify derivatives to reflect their particular activities.

Regulators also require the banks, including the dealer banks, to hold more capital. A capital requirement is the amount of capital a bank or another financial institution has to have according to its financial regulator. To capture capital requirement, most macroeconomic models abstract from liquidity to focus on solvency. Solvency risk is the risk that the business cannot meet its financial obligations for full value even after disposal of its capital. The models assert that as long as the assets are worth more than liabilities, firms should survive. The abstraction from liquidity risk means that by design, macroeconomic models cannot capture “cash flow mismatch,” which is at the heart of financial theories of risk management. This mismatch arises when the cash flows needed to settle liabilities are not equal to the timing of the assets’ cash flows.

The other tool that the Fed uses to monitor systemic risk regularly is macroprudential stress-testing. The Comprehensive Capital Analysis and Review (CCAR) is an annual exercise by the Fed to assess whether the largest bank holding companies have enough capital to continue operations during financial stress. The test also evaluates whether banks can account for their unique risks. However, regulatory stress testing practice is an imperfect tool. Most importantly, these tests abstract away from over-the-counter derivatives—minimally regulated financial contracts among dealer banks— that might contribute to systemic risk. Alternatively, the testing frameworks may not capture network interconnections until it is too late.

The experience of the 2008 financial crisis has revealed the ways in which our current financial infrastructure departs from our theorization of it in textbooks. It also reveals that the analytical and diagnostic tools available to us are inadequate to identifying systemic risk. The Fed’s current tools reflect its activities as the “financial regulator.” But at present, the Fed lacks tools based on its role as lender of last resort, which would enable it to manage the risk rather than imperfectly monitor it. In the following sections, I examine the importance, and economics, of derivatives dealers in managing financial markets’ risks, and propose a tool that extends the Fed’s credit facilities to derivatives dealers during a crisis.

Derivatives Dealers: The Risk Managers of First and Last Resort

Over the course of seventeen years, Bernie Madoff defrauded thousands of investors out of tens of billions of dollars. In a Shakespearean twist, the SEC started to investigate Madoff in 2009 after his sons told the authorities that their father had confessed that his asset management was a massive Ponzi scheme. Madoff pleaded guilty to 11 federal felony counts, including securities fraud and money laundering.

Bernie Madoff paints a dire portrait of the market making in securities. In world of shadow banking, derivatives dealers are the risk managers of first resort. They make the market in hedging derivatives and determine the hedging costs. Like every other dealer, their capacity to trade depends on their ability to access funding liquidity. Unlike most other dealers, there is no room for them in the Fed’s rescue packages during a financial crisis.

Derivatives dealers are at the heart of the financial risk supply chain for two reasons: they determine the cost of hedging, and they act as counterparties to firms’ hedging programs.11 Hedgers use financial derivatives briefly (until an opportunity for a similar reverse transaction arises) or in the long term. In identifying an efficient hedging instrument, they consider liquidity, cost, and correlation to market movements of original risk. Derivatives connect the firms’ ability and willingness to manage risk with the derivatives dealers’ financial condition. In particular, dealers’ continuous access to liquidity enables them to act as counterparties. As intermediaries in risk, dealers use their balance sheets and transfer the risks from risk-averse investors to those with flexible risk appetite, looking for higher returns. In the absence of this intervention, risk-averse investors would neither be willing nor able to manage these risks.

This approach towards risk management concentrates risks in the balance sheets of the derivatives dealers.12 The derivative dealers’ job is to transfer them to the system’s ultimate risk holders. In a typical market-based financial system, investment banks purchase capital market assets, such as mortgage-backed securities (MBS). These hedgers are typically risk-averse and use financial derivatives such as Interest Rate Swaps (IRS), Foreign exchange Swaps (FXS), and Credit Default Swaps (CDS). These derivatives’ primary purpose is to price, or even sell, risks separately and isolate the sources of risk from the underlying assets. Asset managers, who look for higher returns and therefore have a more flexible risk tolerance, hold these derivatives. It is derivatives dealers’ job to make the market in instruments such as CDS, FXS, and IRS. In the process, they provide liquidity and set the price of risk. They also determine the risk-premium for the underlying assets. Crucially, by acting as intermediaries, derivatives dealers tend to absorb the unwanted risks in their own balance sheets.

During a credit crunch, derivatives dealers’ access to funding is limited, making it costly to finance inventories. At the same time, their cash inflow is usually interrupted, and their cash outflow comes to exceed it.13 There are two ways in which they can respond: either they stop acting as intermediaries, or they manage their cash flow by increasing “insurance” premiums, pushing up hedging costs exactly when risk management is most needed. Both of these ultimately transmit the effects to the rest of the financial market. Higher risk premiums which lower the value of underlying assets could lead to a system-wide credit contraction. In the money market, a sudden disruption in the derivatives market would raise the risk premium, impair collateral prices, and increase funding costs.

The increase in risk premium also disrupts the payment system. Derivatives are “mark-to-market,” so if asset prices fall, investors make regular payments to the derivative dealers who transfer them to ultimate risk holders. A system-wide credit contraction might make it very difficult for some investors to make those payments. This faulty circuit continues even if the Fed injects an unprecedented level of liquidity into the system and pursues significant asset purchasing programs. The under-examined hybridity between the market for assets and the market for risks make derivatives markets the Fed’s concern. There will not be a stable capital valuation in the absence of a continuous risk transfer. In other words, the transfer of collateral, used as the mean of payments, depends on the conditions of both the money market and derivatives dealers.

Understanding Financial Assets as Collateral

Maintaining the integrity of the payment system is one of the oldest responsibilities of central bankers. In order to do this effectively, we should recognize financial assets for what they actually do, rather than what economists think they ought to do. Most macroeconomists categorize financial assets primarily as storers of value. But in modern finance, investors want to hold financial assets that can be traded without excessive loss. In other words, they use financial assets as “collaterals” to access credit. Wall Street treats financial assets not as long-term investment vehicles but as short-term trading instruments.

Contemporary financial assets also serve new economic functions. Contrary to the present and fundamental value doctrines, a financial asset today is not valuable in and of itself. Just like any form of money, it is valuable because it passes on. Contemporary financial assets are therefore the backbone of a well-functioning payment system.

The critical point is that in market-based finance, the collateral’s market value plays a crucial role in financial stability. This market value is determined by the value of the asset and the price of underlying risks. The Fed has already embraced its dealer of last resort role partially to support the cost of diverse assets such as asset-backed securities, commercial papers, and municipal bonds. However, it has not yet offered any support for backstopping the price of derivatives. In other words, while the Fed has provided support for most non-bank intermediaries, it overlooked the liquidity conditions in the derivatives market. The point of such intervention is not so much to eliminate the risk from the market. Instead, the goal is to prevent a liquidity spiral from destabilizing the price of assets and, consequently, undermining their use as collateral in the market-based credit.

In 2008, AIG was the world’s largest insurance company and a bank owner. Its insurance business and bank subsidiary made it one of the largest derivatives dealers. It had written billions of dollars of credit default swaps (CDSs), which guaranteed buyers in case some of the bonds they owned went into default. The goal was to ensure that the owner of the swap would be paid whole. Some investors who owned the bonds of Lehman had bought the CDSs to minimize the loss if Lehman defaulted on its bonds. The day after Lehman failed, the Fed lent $85 billion to AIG, stabilizing it and containing the crisis. However, this decision was due to the company’s importance in markets for municipal bonds, commercial papers, and money market mutual funds. If it was not unwilling to do the same for derivatives dealers, it may not be able to alleviate near-term risks generated from the systemic losses on derivatives.

After the COVID-19 pandemic, the Fed extended credit facilities to critical financial intermediaries, but excluded market makers in risk. But in a financialized economy, the business cycle is nothing more than extreme corrections to the price of capital. Before a crash, investors’ risk tolerance becomes flexible—they ignore the possibility for market corrections or rapid changes in an asset’s market price after the establishment of an equilibrium price. As a result of this bias, investors’ expectations of asset prices form more slowly than actual changes in asset prices. Hedging would save these biased investors, and if done appropriately, they could help stabilize the business cycle. However, the Fed has no formal tool that enables it to support derivatives dealers in providing hedging services. It cannot act as the “ultimate” risk manager in the system.

The Dealer Option: Connecting the Fed with the Ultimate Risk Managers

Charles Kindleberger argued that financial crises cannot be stopped, but only contained. The dealer option proposed in this paper would enable the Fed to control the supply chain of risk.14 It extends credit facilities to a specific type of financial intermediaries: options dealers. This extension does not include financial speculators of various stripes and nonfinancial corporations—the so-called “end-users” of derivatives—seeking to hedge commercial risks. The options dealers’ importance comes from their paradoxical effects on financial stability. Since Dodd-Frank increased firms’ capital cost in favor of risk mitigation techniques like hedging, these companies are crucial to policy because they buy protection from options dealers in centrally cleared markets.

The problem is that options dealers’ role as counterparty to hedging firms could create fragility and magnify the market risk.15 In equilibrium, the risk is transferred through the option supply chain to dealers, who are left with the ultimate task to manage their risk exposure using dynamic hedging techniques. The dynamic nature of these activities means options dealers contribute to daily volatility when they balance their exposures. During a crisis, these actions lead to increasing market fragility. The “dealer option” empowers the Fed to become the lender of last resort to the financial system’s ultimate risk managers. This instrument extends many benefits that banks receive by having an account at the Fed to these dealers. Some of these benefits include having access to reserves, receiving interest on reserves, and in very desperate times, access to the Fed’s liquidity facilities. The goal is to strike a balance between the fragility and stability they impose on the market.16

Containing liquidity risk is at the heart of the dealer option. The daily cash flow that the options contracts generate could contribute to asset fire sales during a crisis—options contracts are subject to mark-to-market rules, and fluctuations in the value of assets that dealers hold generate daily cash flows. If dealers do not have enough liquidity to make daily payments, known as margin calls, they will sell the underlying assets. Asset fire sales might also arise because most market makers have an institutional mandate to hedge their positions by the end of the trading day. Depending on the price changes, the hedging activities require dealers to buy or sell the underlying asset. Most dealers hedge by selling shares of the underlying asset if the underlying asset’s value drops, potentially giving rise to firesale momentum. Limited market liquidity during a crisis means that the possibility of firesale is larger when dealers do not have enough liquidity to meet their cash flow requirements. The dealer option could stop this cycle. In this structure, the Fed’s function to provide backstops for derivatives dealers can reduce firesales’ risk and contain market fragility during a credit crunch.

The tool is based on Perry Mehrling’s Money View framework, Morgan Ricks, John Crawford, and Lev Menand’s Public Option proposal, and Katharina Pistor’s Legal Theory of Finance (LTF). The public option suggests opening the Fed’s balance sheet to non-banks and the public. On the other hand, the Money View emphasizes the importance of managing the timing of cash flows and calls any mismatches liquidity risk. Like the Finance view of the world, the Money View asserts that the goal is to meet “survival constraints” at all times.

The LTF builds on the Money View through four essential premises: first, financial markets are a rule-bound system17; The more an entity solidifies its position within the marketplace, the higher the government’s level of responsibility. Second, there is an essential hybridity between states and markets; in a financial crisis, only Fed’s balance sheet—with its unlimited access to high-powered money—can guarantee full convertibility from financial assets into currency. Third, the law is what makes enforcement of financial instruments possible. On the other hand, these enforcements also have the capacity to bring the financial system down. Finally, LTF law is elastic, meaning that legal constraints can be relaxed or tightened depending on the economy’s health.

Calling the Fed to intervene in the derivatives market, the “dealer option” emphasizes the financial system’s hybridity. The law does not currently require central banks to offer convertibility to most assets. In most cases, they are explicitly barred from doing so. Legal restrictions like this could be preventing effective policy options from restoring financial stability. The dealer option would defy such restrictions and allow derivatives dealers to have an account at the Fed. The Fed’s traditional indirect backstopping channel has proven to be inadequate during most financial crises. Banks tend to reduce or sometimes cease their liquidity provision during a crisis. Accounting for such shifts in banks’ business models, the dealer option allows the Fed to directly backstop the leading players in the supply chain of risk. Importantly, these benefits would only be accessible for derivatives dealers once a recession is looming or already in full effect, when unconventional monetary policy tools are used.

Whether a lender of last resort should provide liquidity to forestall panic has been debated for more than two hundred years. Those who oppose the provision of liquidity from a lender of last resort argue that the knowledge that such credits will be available encourages speculation. Those who want a lender of last resort worry more about coping with the current crisis and reducing the likelihood that a liquidity crisis will cascade into a solvency crisis and trigger a severe recession. After the 2008 crisis, the use of derivatives for hedging has greatly increased due to the growing emphasis on risk management. Solvency II, Dodd-Frank, and the EMIR Risk Mitigation Regulation increased the cost of capital in favor of risk mitigation techniques, including hedging and reducing counterparty risk. The risk is transferred over the option supply chain to market makers, who are left with the ultimate task to manage their risk exposure. The dealer option offers liquidity to these dealers during a crisis when the imbalances are huge. Currently, there is no lender of last resort for the market for risk because there is neither a consensus about the systemic importance of shadow banking nor any model adequately equipped to distinguish between hedge finance, speculative finance, and Ponzi finance.

Shadow banking has three foundations: liquid assets, global dollar funding, and risk management. So far, the Fed has left the last foundation unattended. In order to design tools that fill the void between risk management and crisis prevention, we must understand the financial ecosystem as it really is, and not as we want it to be.

Elham Saeidinezhad is lecturer in Economics at UCLA. Before joining the Economics Department at UCLA, she was a research economist in International Finance and Macroeconomics research group at Milken Institute, Santa Monica, where she investigated the post-crisis structural changes in the capital market as a result of macroprudential regulations. Before that, she was a postdoctoral fellow at INET, working closely with Prof. Perry Mehrling and studying his “Money View”. Elham obtained her Ph.D. from the University of Sheffield, UK, in empirical Macroeconomics in 2013. You may contact Elham via the Young Scholars Directory

- Saeidinezhad, E., 2020. “When it Comes to Market Liquidity, What if Private Dealing System is Not ‘The Only Game in Town’ Anymore? (Part I).” Available at: http://elhamsaeidinezhad.com ↩

- Stigum, M., 2007. Stigum’s Money Market. McGraw-Hill Professional Publishing ↩

- Saeidinezhad, E., 2020. “When it Comes to Market Liquidity, What if Private Dealing System is Not ‘The Only Game in Town’ Anymore? (Part II).” Available at: http://elhamsaeidinezhad.com ↩

- Minsky, Hyman P. 1986. Stabilizing an unstable economy. New Haven: Yale University Press. ↩

- Mian, A, and Sufi, A., 2010. “The Great Recession: Lessons fromMicroeconomic Data.” American Economic Review, 100 (2): 51-56. ↩

- Mehrling, P., 2011. Fischer Black and the Revolutionary Idea of Finance. Wiley Publications; ISBN: 978-1-118-20356-9 ↩

- Black, F., 1982. “General Equilibrium and Business Cycles.” NBER Working Paper No. w0950. ↩

- Scholes, M. S., 1995. “Fischer Black. Journal of Finance,” American Finance Association, vol. 50(5), pages 1359-1370, December. ↩

- Black, F., 1989. “Equilibrium Exchange Rate Hedging.” NBER Working Paper No. w2947. ↩

- Schwarcz, S., 2008. “Identifying and Managing Systemic Risk: An Assessment of Our Progress.” Harvard Business Law Review. ↩

- Canadian Derivatives Institute., 2018. “Corporate Hedging During the Financial Crisis.” Working paper; WP 18-04. ↩

- Wayne, G and Kothar, S. P., 2003. “How Much Do Firms Hedge With Derivatives?” Journal of Financial Economics 70 (2003) 423–461 ↩

- Gary, G., and Metrick, A., 2012. “Securitized Banking and the Run on Repo.” Journal of Financial Economics, Volume 104, Issue 3, Pages 425-451, ISSN 0304-405X. ↩

- Aliber, Robert Z., and Kindleberger, C., 2011. Manias, Panics, and Crashes: a History of Financial Crises. New York: Palgrave Macmillan ↩

- Barbon, A., and Buraschi, A., 2020. “Gamma Fragility.” The University of St.Gallen, School of Finance Research Paper No. 2020/05. ↩

- Mehrling, P., 2011. The New Lombard Street: How the Fed Became the Dealer of Last Resort. Princeton; Oxford: Princeton University Press. ↩

- Pistor, K. 2013a. “Law in Finance, Journal of Comparative Economics,” Elsevier, vol. 41(2), pages 311-314. ↩