A Review of Perry Mehrling’s Paper on the Law of Reflux

By Elham Saeidinezhad | Perry Mehrling’s new paper, “Payment vs. Funding: The Law of Reflux for Today,” is a seminal contribution to the “Money View” literature. This approach, which is put forward by Mehrling himself, highlights the importance of today’s cash flow for the survival of financial participants. Using Money View, this paper examines the implications of Fullarton’s 1844 “Law of Reflux” for today’s monetary system. Mehrling uses balance sheets to show that at the heart of the discrepancy between John Maynard Keynes’ and James Tobin’s view of money creation is their attention to two separate equilibrium conditions. The former focuses on the economy when the initial payment takes place while the latter is concerned about the adjustments in the interest rates and asset prices when the funding is finalized. To provide such insights into several controversies about the limits of money finance, Mehrling’s analysis relies deeply on one of the structural premises of the Money View; the notion that the payment system that enables the cash flow to transfer from a deficit agent to the surplus agent is essentially a credit system. However, when we investigate the future that the Money View faces, this sentiment is likely to be threatened by a few factors that are revolutionizing financial markets. These elements include but are not limited to the Fed’s Tapering and post-crisis financial regulations and constrain banks’ ability to expand credit. These restrictions force the payment system to rely less on credit and more on reserves. Hence, the future of Money View will hinge on its ability to function under new circumstances where the payment system is no longer a credit system. This puzzle should be investigated by those of us who consider ourselves as students of this View.

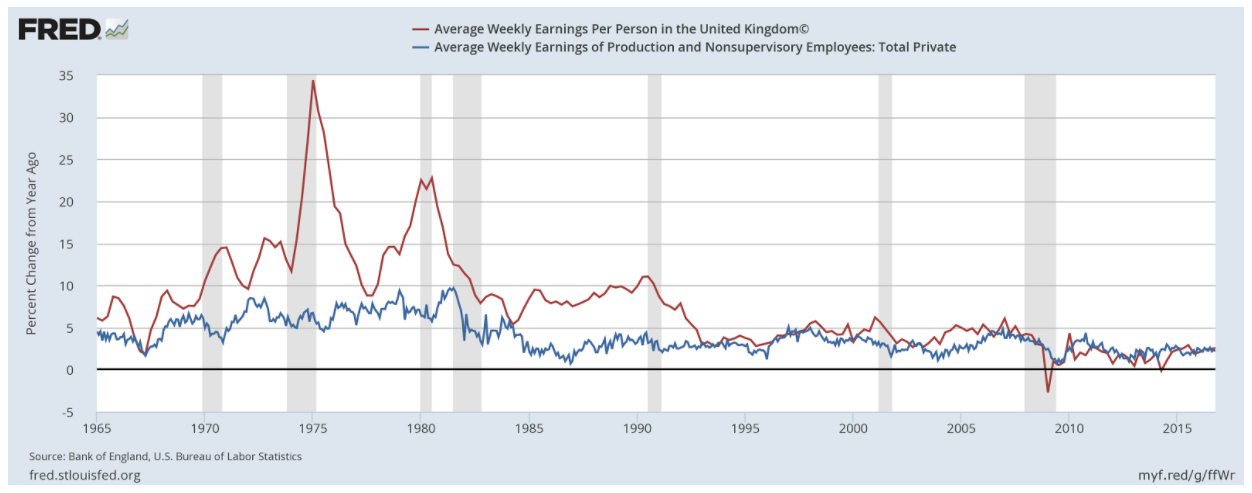

Mehrling, in his influential paper, puts on his historical and monetary hats to clarify a long-standing debate amongst Keynesian economists on the money creation process. In understanding the effect of money on the economy, “old” Keynesians’ primary focus has been on the market interest rate and asset prices when the initial payment is taking place. In other words, their chief concern is how asset prices change to make the new payment position an equilibrium. To answer this question, they use the “liquidity preference framework” and argue that asset prices are set as a markup over the money rate of interest. The idea is that once the new purchasing power is created, the final funding can happen without changing asset prices or interest rates. The reason is that the initial increase in the money supply remains entirely in circulation by creating a new demand for liquid balances for various reasons. Put it differently, although the new money will not disappear on the final settlement date, the excess supply of money will be eliminated by the growing demand for money. In this situation, there is no reflux of the new purchasing power.

In contrast, the new Keynesian orthodoxy, established by James Tobin, examines the effects of money creation on the economy by focusing on the final position rather than the initial payment. At this equilibrium, the interest rate and asset prices will be adjusted to ensure the final settlement, otherwise known as funding. In the process, they create discipline in the monetary system. Using “Liquidity Preference Framework”, these economists argue that the new purchasing power will be used to purchase long-term securities such as bonds. In other words, the newly created money will be absorbed by portfolio rebalancing which leads to a new portfolio equilibrium. In this new equilibrium, the interbank credit will be replaced by a long-term asset and the initial payment is funded by new long-term lending, all outside the traditional banking system. Tobin’s version of Keynesianism extracted from both the flux of bank credit expansion and the reflux of subsequent contraction by only focusing on the final funding equilibrium. It also shifts between one funding equilibrium and another since he is only interested in final positions. In the new view, bank checkable deposits are just one funding liability, among others, and their survival in the monetary system entirely depends on the portfolio preferences of asset managers.

The problem is that both views abstract from the cash flows that enable a continuous payment system. These cash flows are key to a successful transition from one equilibrium to another. Money View labels these cash flows as “liquidity” and puts it at the center of its analysis. Liquidity enables the economy to seamlessly transfer from initial equilibrium, when the payment takes place, to the final equilibrium, when the final funding happens, by ensuring the continuity of the payment system. In the initial equilibrium, payment takes place since banks expand their balance sheets and create new money. In this case, the deficit bank can borrow from the surplus bank in the interbank lending market. To clear the final settlement, the banks can take advantage of their access to the central bank’s balance sheet if they still have short positions in reserve. Mehrling uses these balance sheets operations to show that it is credit, rather than currency or reserves, that creates a continuous payment system. In other words, a credit-based payment system lets the financial transactions go through even when the buyers do not have means of payment today. These transactions, that depend on agents’ access to liquidity, move the economy from the initial equilibrium to the ultimate funding equilibrium.

The notion that the “payment system is a credit system” is a defining characteristic of Money View. However, a few developments in the financial market, generated by post-crisis interventions, are threatening the robustness of this critical assumption. The issue is that the Fed’s Tapering operations have reduced the level of reserves in the banking system. In the meantime, post-crisis financial regulations have produced a balance sheet constrained for the banking system, including surplus banks. These macroprudential requirements demand banks to keep a certain level of High-Quality Liquid Assets (HQLA) such as reserves. At the same time, the Global Financial Crisis has only worsened the stigma attached to using the discount loan. Banks have therefore become reluctant to borrow from the Fed to avoid sending wrong signals to the regulators regarding their liquidity status. These factors constrained banks’ ability to expand their balance sheets to make new loans to the deficit agents by making this activity more expensive. As a result, banks, who are the main providers of the payment system, have been relying less on credit and more on reserves to finance this financial service.

Most recently, Zoltan Pozsar, a prominent scholar of the Money View, has warned us that if these trends continue, the payment system will not be a credit system anymore. Those of us who study Money View realize that the assumption that a payment system is a credit system is the cornerstone of the Money View approach. Yet, the current developments in the financial ecosystem are fundamentally remodeling the very microstructure that has initially given birth to this conjecture. It is our job, therefore, as Money View scholars, to prepare this framework for a future that is going to put its premises on trial.

Elham Saeidinezhad is lecturer in Economics at UCLA. Before joining the Economics Department at UCLA, she was a research economist in International Finance and Macroeconomics research group at Milken Institute, Santa Monica, where she investigated the post-crisis structural changes in the capital market as a result of macroprudential regulations. Before that, she was a postdoctoral fellow at INET, working closely with Prof. Perry Mehrling and studying his “Money View”. Elham obtained her Ph.D. from the University of Sheffield, UK, in empirical Macroeconomics in 2013. You may contact Elham via the Young Scholars Directory