A friend recently told me that he voted for Donald Trump, despite the candidate’s racist approach, because racism is “something that hasn’t existed [in America] for sooo long.”

We know some groups of voters—e.g. the KKK—deliberately organized and voted not to “make America great again” but to make America white again. While we don’t know how many of this type there are, we know they couldn’t have elected Trump on their own. They had help from people like my college-educated friend, who thinks racism is confined to history books. This tells us a lot about the degree to which voters are misinformed. Millions of people decanted towards a racist candidate even though they don’t consider themselves to be racists. The election made it clear that there are enough people like my friend to get Donald Trump elected.

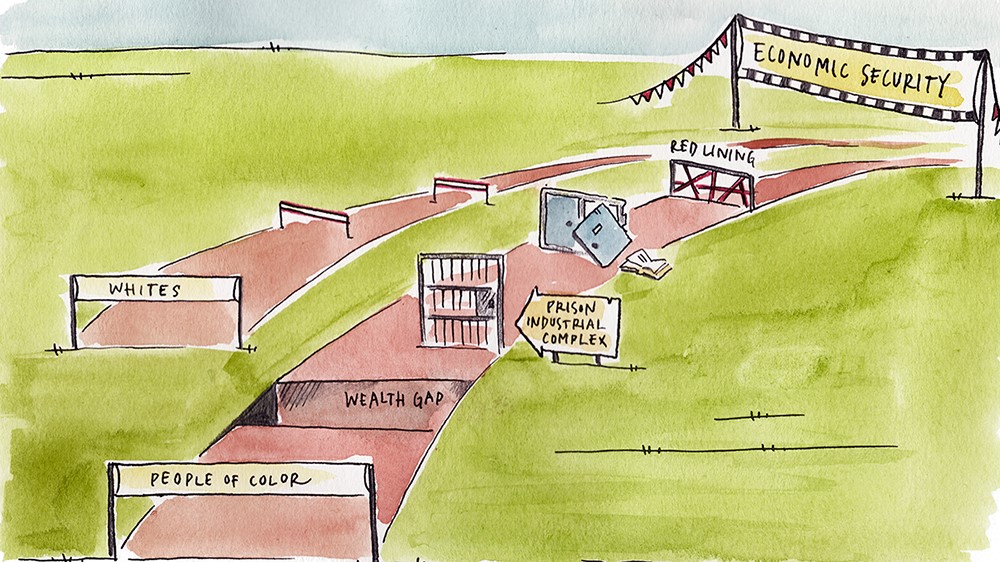

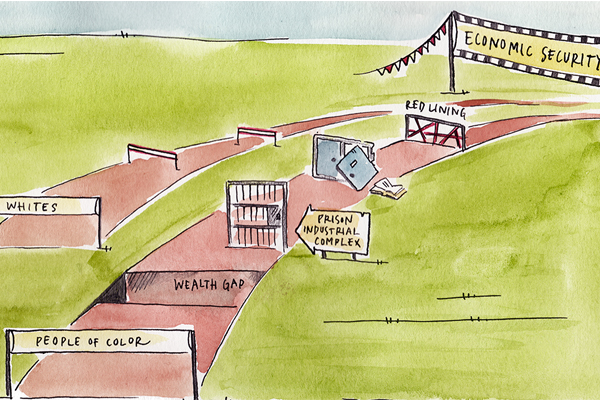

In our last piece we discussed Dean Baker’s book, which shows that many policies and institutions disproportionately benefit the social elite, and in effect, further marginalize the already marginalized and perpetuate inequality. People of color have long been kept down by policies and institutions that favor the hegemonic class. Racism will not be an issue of the past as long as we have a rigged socio-economic system that systematically breaks down communities of people of color, concentrates poverty to their neighborhoods, cripples their educational opportunities, and limits their access to better incomes and wealth accumulation. The numbers below speak to such current racial disparities.

Wealth and income inequality

Figure 1 shows the disparities between selected races, in terms of wealth, income, home equity, and savings for retirement. As can be seen in the figure, in 2013 net worth for white households was almost 13 times larger than that of African-Americans and 10 times higher than that of Hispanics.

Figure 1. Median Household Wealth, Income, Home

Equity, and Retirement Savings by race, for 2013

Not only did whites hold more wealth, but whites also receive higher incomes. A black or Hispanic household in the middle of the income distribution is likely to receive only as much as 58 percent as its white counterpart. While the amounts of savings for retirement for average white households are 4 times larger than those for black or Hispanic.

White households not only have larger sums saved for retirement, but also over 54 percent of these households have some kind of savings. Meanwhile the percentage of black or Hispanic households with savings is considerably lower, as shown in Table 1 below.

Table 1. Percentage of households

with savings and home equity, by race for 2013

| Savings | Retirement Savings | Home Equity | |

| White | 54 | 57 | 70 |

| Black | 39 | 34 | 38 |

| Hispanic | 37 | 26 | 38 |

Source: Authors’ calculations per

The Survey of Consumer Finances (2013)

Table 1 also shows that average white households are more likely to have equity on their homes. While in 2014 homeownership rates for whites households was at least 26 percentage points larger than the other two groups analyzed here, making whites 1.6 times more likely to own a home—the principal source of wealth-building for most Americans.

Educational Attainment

People of color see their access to incomes and wealth building opportunities severely crippled by educational attainment. Figure 2 below offers a breakdown of educational attainment within each race, using household data. It shows, for example, that 77 and 87 percent of all blacks and Hispanics household heads have less than a College degree as their highest level of education, respectively, while 62 percent of white household heads have less than a completed college education. These differences increase for higher levels of education. As the figure shows, only 7 percent of blacks and 5 percent of Hispanics obtain a graduate degree.

Figure 2. Highest Educational Attainment of Household Head Within Each Race

Moreover, a college degree is not a guarantee of financial success in the future, at least not for non-white families. Even if they attend college, the median wealth return to college graduation for Black and Hispanic households is 9 and 8 percent, respectively, of the returns that accrue to white households, as shown in Table 2. Meaning that for every $1 in wealth that accumulates to Black and Hispanic families, white families accrue $11.5 and $13.33, respectively.

Table 2. Median Wealth Return to College Graduation, 2011

| White | Black | Hispanic | |

| Median Returns to College | $55,869 | $4,846 | $4,191 |

Source: Demos analysis of Survey of Income

and Program Participation (SIPP), 2011.

Mass incarceration

The rapid increases in incarceration rates in the U.S. beginning in the mid-1970s have disproportionately affected people of color. By 2008, African-Americans and Hispanics were being incarcerated at a rate 6 times greater than whites and they represented 58 percent of all prisoners, even though blacks and Hispanics only comprise around 25 percent of U.S. population. By 2010, 1 out of 3 high school dropout black male between 20 to 39 years old were imprisoned; compared to just 13 percent for whites with similar characteristics.

As an election-relevant impact of the era of mass incarceration, it is estimated that 1 in 13 African Americans of voting age are deprived of their right to vote as a consequence of voting restrictions imposed by twelve states, with the sole objective of disenfranchising individuals after they have completed their sentences; more than 7 percent of black adults are disenfranchised, while the same restrictions apply to 1.8 percent of non-African-Americans.

The result is that it is estimated that 1 in 3 black males born today is likely to spend some time in prison. And even after they serve their time, wages for black ex-inmates tend to grow 21 percent slower than those of white ex-inmates.

Red lining and exclusionary zoning

Exclusionary zoning and red lining are policies that effectively deny affordable housing and other services—e.g. banking, insurance, supermarkets—to certain groups of the population based on their incomes, race, or ethnicity. It has been widely reported how those policies make it difficult for people of color to find homes in good, safe neighborhoods with access to quality education, employment opportunities, and quality healthcare. The impact of these policies is the creation of race and income segregated areas, with poverty and wealth concentrating in different neighborhoods. It is estimated that a black person is over 3 times more likely to reside in neighborhoods with high poverty concentration than a white person, while Hispanics are twice more likely than whites.

A close reminder of how African-Americans suffer this issue is that the President-elect of the U.S. was investigated and eventually sued by the Justice Department for discriminating against potential black tenants in his company’s buildings; what The New York Times called “the color barrier of the Trump real estate empire.”

These are only a few selected facts, but there are many more; these facts are not as evident to everyone, nor do they capture headlines on TV and Facebook like, e.g., police shootings of unarmed African-Americans.

This piece does not address the reasons, causes, and policies that got us to this point. This is nothing close to a history of racism in America and these are by no means the only injustices that people of color suffer in this country. However, after seeing all this, it should be evident that racism is not an issue of the past—certainly not one for the history books. There are still many people today that lived in racially segregated states under the Jim Crow laws. They had to literally fight for their rights to vote, to access the same schools as whites, or just to sit in the front of a bus. We might not have legal Jim Crow-style discrimination anymore, but American institutions covertly retain remnants of the Jim Crow era. Meanwhile the rich and powerful have rigged American socio-economic institutions with a bias towards their class and race, perpetuating an oppressive system that pretty much defines our place in society according to the color of our skin and the class status of the families from which we are born.

Now, my friend, be careful with any “buts” you might want consider as retort. If you are still not convinced that there is a deeply-rooted-institutionalized race problem in America, then go further than this piece, be curious about it, turn to your black and brown friends—ask them about it, and hear what they have to say.

Post co-written by Daniella Medina and Oscar Valdes-Viera

Illustration by Heske van Doornen

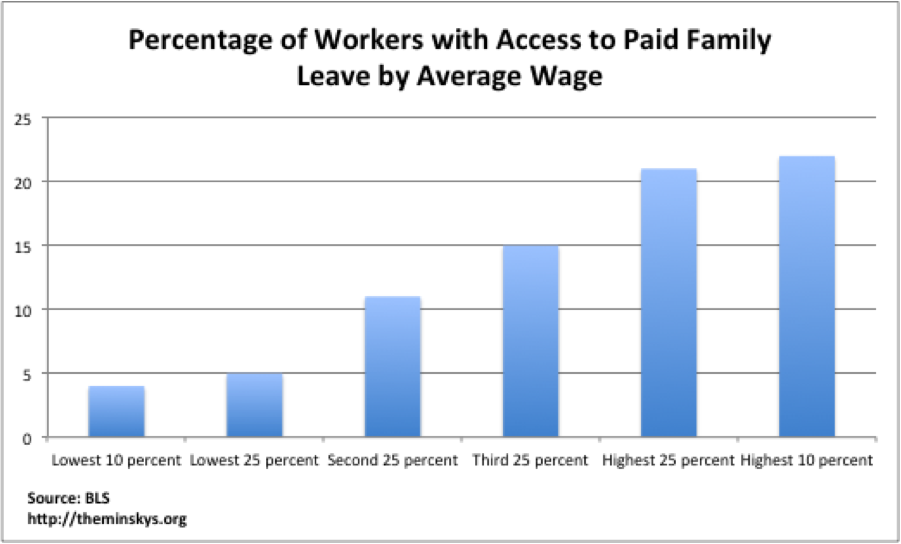

months for a company that hires at least 50 people. While this might be a start, it leaves about half of the workers uncovered. Even for those who are covered by the FMLA, they must afford giving up their paychecks for those 12 weeks. The act does little to help those who are left out or cannot afford to renounce their paychecks. This adds pressure on people at the lower end of the income distribution that might be pushed below the poverty line if forced to give up their incomes.

months for a company that hires at least 50 people. While this might be a start, it leaves about half of the workers uncovered. Even for those who are covered by the FMLA, they must afford giving up their paychecks for those 12 weeks. The act does little to help those who are left out or cannot afford to renounce their paychecks. This adds pressure on people at the lower end of the income distribution that might be pushed below the poverty line if forced to give up their incomes. introducing the policy had a positive or no noticeable effect on 89 percent of the businesses surveyed. However, these policies are very modest compared to the rest of the

introducing the policy had a positive or no noticeable effect on 89 percent of the businesses surveyed. However, these policies are very modest compared to the rest of the

disproportionately affects lower-income families is the cost of childcare. The Economic Policy Institute

disproportionately affects lower-income families is the cost of childcare. The Economic Policy Institute  With childcare costs

With childcare costs