These are the latest reflections from new thinkers around the on what should have been done already, what must be done next, and what the near future may look like:

1 | New Study Reveals Stark Picture of Bay Area Poverty Leading up to Covid-19 Pandemic, in Tipping Point Community, by john a. powell.

“Known for its progressive politics and rich diversity, the San Francisco Bay Area is no exception to patterns of systemic racial and economic inequality found across the nation,” said john a. powell, Director of the Othering & Belonging Institute at UC Berkeley. “In fact, the Bay Area’s hot housing market and booming economy may exacerbate these trends, making it harder for low-skilled workers to find affordable housing and pay their bills. This study, drawing upon an original survey of Bay Area residents and census data, gives us a vivid portrait of poverty and inequality, and what we should do about it, even before the COVID-19 pandemic occurred. Now this research is more urgent than ever.”

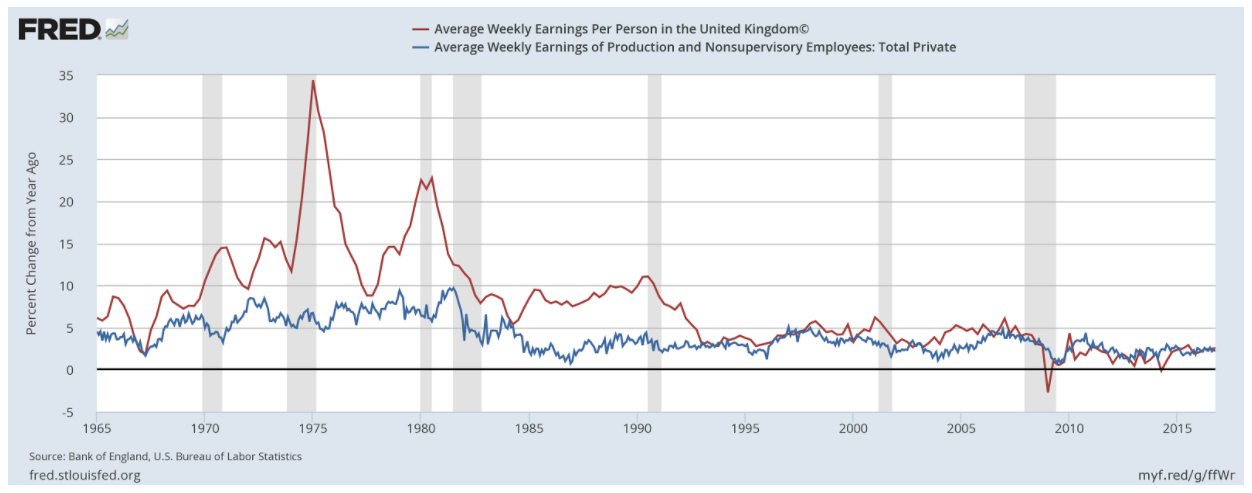

2 |30 million Americans are unemployed. Here’s how to employ them in Vox, by Pavlina Tcherneva

“But the program will actually stabilize these fluctuations. There are reasons unemployment feeds on itself. If you have this kind of preventative program, where people trickle into other employment rather than unemployment, their spending patterns are stabilized, so you have smaller fluctuations in the private sector. We see this in countries that have active labor-market policies, that do a lot more public employment than we do.”

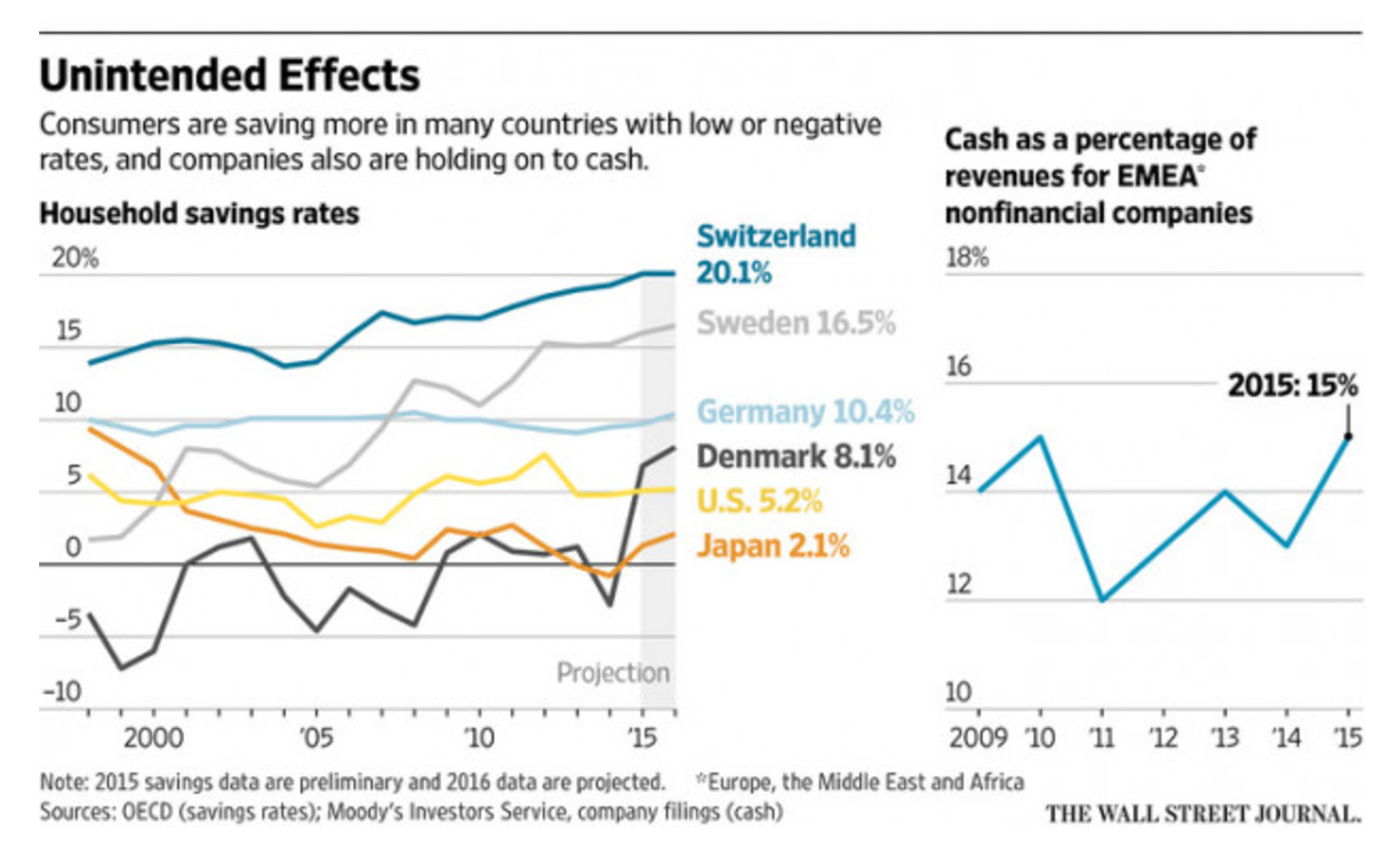

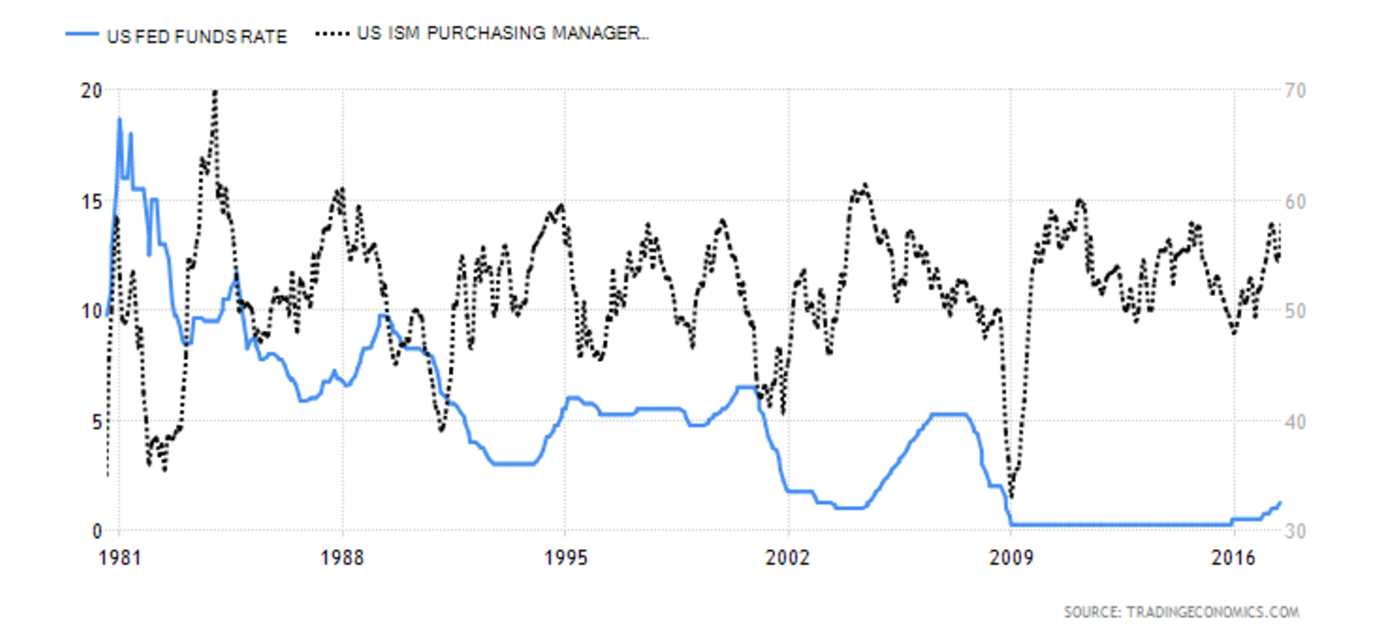

3 | Messages from “Fiscal Space” in Project Syndicate by Jayati Ghosh

“Well before the pandemic arrived, it was evident that the financialization of the global economy was fueling massive levels of inequality and unnecessary economic volatility. In this unprecedented crisis, the need to rein it in has literally become a matter of life or death.”

4 | The ‘frugal four’ should save the European project in Social Europe by Peter Bofinger

“It is therefore crucial that the frugal four [Austria, Denmark, Sweden and the Netherlands] abandon their opposition to a joint financing facility at EU level. Only in this way will the European project be able to survive and Europe respond to this terrible crisis in a manner as effective as in the United States. For, as the US economist Paul Krugman has put it, paraphrasing Franklin Roosevelt, ‘The only fiscal thing to fear is deficit fear itself.’”

5 | Making the Best of a Post-Pandemic World, in Project Syndicate, by Dani Rodrik

“It is possible to envisage a more sensible, less intrusive model of economic globalization that focuses on areas where international cooperation truly pays off, including global public health, international environmental agreements, global tax havens, and other areas susceptible to beggar-thy-neighbor policies. Insofar as the world economy was already on a fragile, unsustainable path, COVID-19 clarifies the challenges we face and the decisions we must make. In each of these areas, policymakers have choices. Better and worse outcomes are possible. The fate of the world economy hinges not on what the virus does, but on how we choose to respond.”

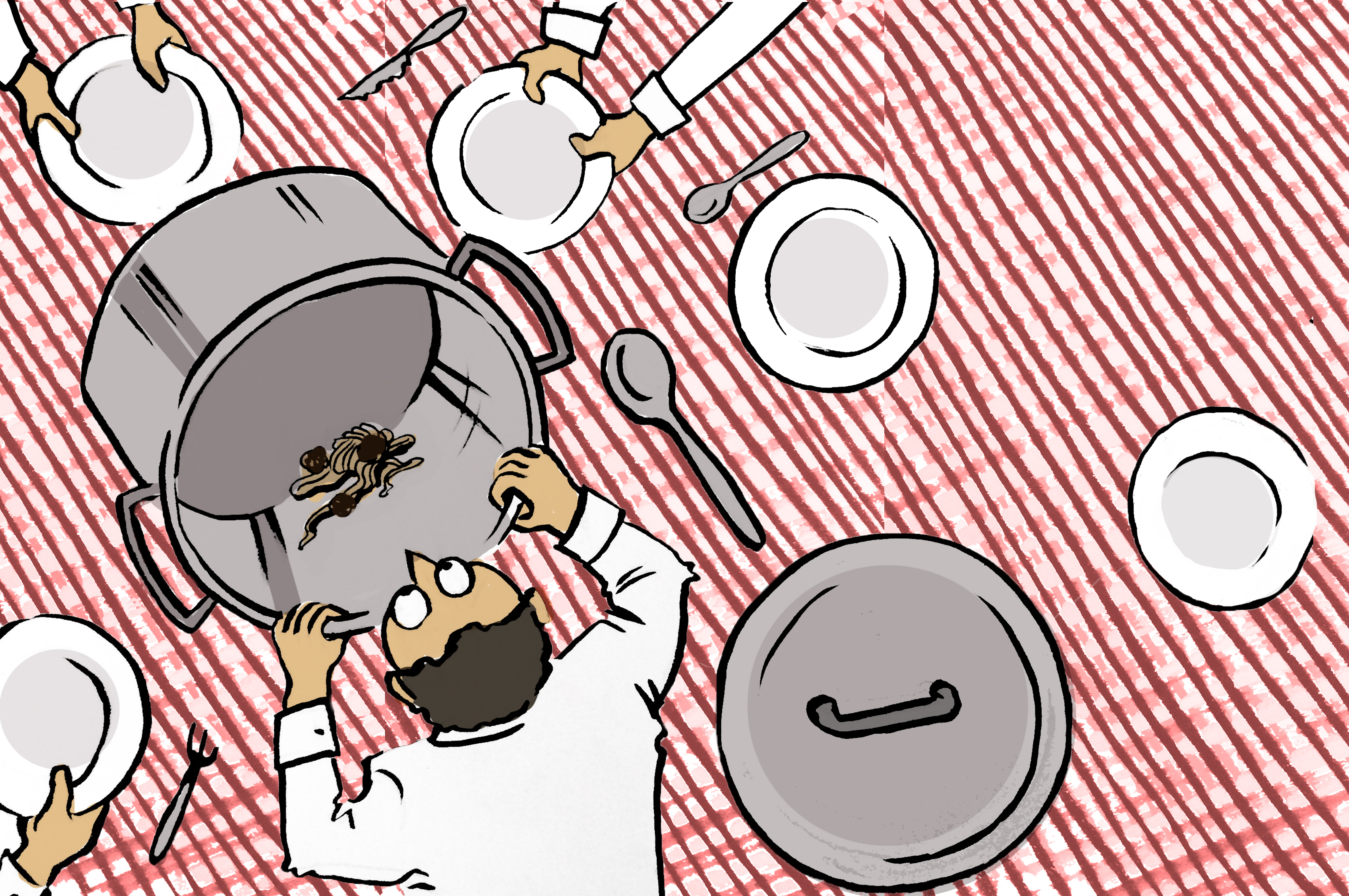

6 | Two Rounds of Stimulus Were Supposed to Protect Jobs — Instead We Have Record Unemployment with Tom Ferguson in the Institute for Public Accuracy

“We all know that the U.S. response to COVID-19 has lagged far behind other countries. But now a real trap is closing. The public premise of the government stimulus programs was that they would be needed only for a short period and channeling aid to businesses would enable them to retain workers on their payrolls. So vast sums were handed out while the Federal Reserve intervened massively in financial markets. But now unemployment is soaring, in a country whose health insurance system is keyed to the workplace. Small businesses are collapsing and plainly never got much aid. Workers are also dropping out of the workforce in enormous numbers while a major health and safety crisis rages. Government policy has got to address these issues before it’s too late. It can’t simply grant blanket immunity to businesses for the sake of a hasty, premature reopening. A major re-calibration of policy is in order.”

Every week, we share a few noteworthy articles that showcase the work of new economic thinkers around the world. Subscribe to receive these shortlists directly to your email inbox.