This piece is a follow up to our previous Money View article on the banking system during the COVID-19 crisis.

By Elham Saeidinezhad and Jack Krupinski |The COVID-19 crisis created numerous financial market dislocations in the U.S., including in the market for government support. The federal government’s Paycheck Protection Program offered small businesses hundreds of billions of dollars so they could keep paying employees. The program failed to a great extent. Big companies got small business relief money. The thorny problem for policymakers to solve is that the government support program is rooted in the faith that banks are willing to participate in. Banks were anticipated to act as an intermediary and transfer funds from the government to the small businesses. Yet, in the modern financial system, banks have already shifted gear away from their traditional role as a financial intermediary between surplus and deficit agents. Part l used the “Money View” and a historical lens to explain why banks are reluctant to be financial intermediaries and are more in tune with their modern function as dealers in the wholesale money markets. In Part ll, we are going to propose a possible resolution to this perplexity. In a monetary system where banks are not willing to be financial intermediaries, central banks might have to seriously entertain the idea of using central bank digital currency (CBDC) during a crisis. Such tools enable central banks to circumvent the banking system and inject liquidity directly to those who need it the most, including small and medium enterprises, who have no access to the capital market.

The history of central banking began with a simple task of managing the quantity of money. Yet, central bankers shortly faced a paradox between managing “survival constraint” in the financial market and the real economy. On the one hand, for banks, the survival constraint in the financial market takes the concrete form of a “reserve constraint” because banks settle net payments using their reserve accounts at the central bank. On the other hand, according to the monetarist idea, for money to have a real purchasing power in terms of goods and services, it should be scarce. Developed by the classical economists in the nineteenth and early twentieth centuries, the quantity theory of money asserted that the quantity of money should only reflect the level of transactions in the real economy.

The hybridity between the payment system and the central bank money created such a practical dilemma. Monetarist idea disregarded such hybridity and demanded that the central bank abandon its concern about the financial market and focus only on controlling the never-materializing threat of inflation. The monetarist idea was doomed to failure for its conjectures about the financial market, and its illusion of inflation. In the race to dominate the whole economy, an efficiently functioning financial market soon became a pre-condition to economic growth. In such a circumstance, the central bank must inject reserves or else risk a breakdown of the payments system. Any ambiguity about the liquidity problems (the survival constraint) for highly leveraged financial institutions would undermine central banks’ authority to maintain the monetary and financial stability for the whole economy. For highly leveraged institutions, with financial liabilities many times larger than their capital base, it doesn’t take much of a write-down to produce technical insolvency.

This essential hybridity, and the binding reality of reserve constraint, gave birth to two parallel phenomena. In the public sphere, the urge to control the scarce reserves originated monetary policy. The advantage that the central bank had over the financial system arose ultimately from the fact that a bank that does not have sufficient funds to make a payment must borrow from the central bank. Central bankers recognized that they could use this scarcity to affect the price of money, the interest rate, in the banking system. It is the central bank’s control over the price and availability of funds at this moment of necessity that is the source of its control over the financial system. The central bank started to utilize its balance sheet to impose discipline when there was an excess supply of money, and to offer elasticity when the shortage of cash is imposing excessive discipline. But ultimately central bank was small relative to the system it engages. Because the central bank was not all-powerful, it must choose its policy intervention carefully, with a full appreciation of the origins of the instability that it is trying to counter. Such difficult tasks motivated people to call central banking as the “art,” rather than the “science”.

In the private domain, the scarcity of central bank money significantly increased the reliance on the banking system liabilities. By acting as a special kind of intermediary, banks rose to the challenge of providing funding liquidity to the real economy. Their financial intermediation role also enabled them to establish the retail payment system. For a long time, the banking system’s major task was to manage this relationship between the (retail) payment system and the quantity of money. To do so, they transferred the funds from the surplus agents to the deficit agents and absorbed the imbalances into their own balance sheets. To strike a balance between the payment obligations, and the quantity of money, banks started to create their private money, which is called credit. Banks recognized that insufficient liquidity could lead to a cascade of missed payments and the failure of the payment system as a whole.

For a while, banks’ adoption of the intermediary role appeared to provide a partial solution to the puzzle faced by the central bankers. Banks’ traditional role, as a financial intermediary and providers of indirect finance, connected them with the retail depositors. In the process, they offered a retail payment- usually involve transactions between two consumers, between consumers and small businesses, or between two small to medium enterprises. In this brave new world, managing the payment services in the financial system became analogous to the management of the economy as a whole.

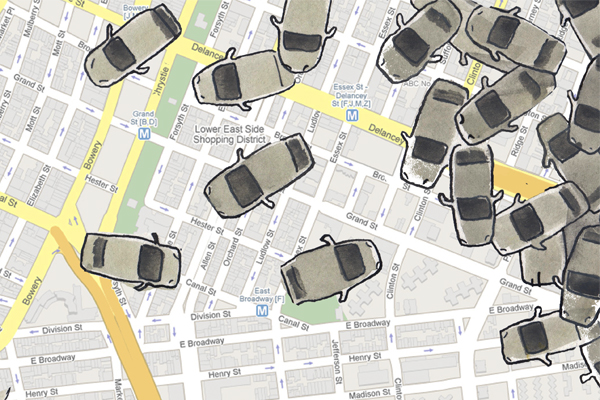

Most recently, the COVID-19 crisis has tested this partial equilibrium again. In the aftermath of the COVID-19 outbreak, both the Fed and the U.S. Treasury coordinated their fiscal and monetary actions to support small businesses and keep them afloat in this challenging time. So far, a design flaw at the heart of the CARES Act, which is an over-reliance on the banking system to transfer these funds to small businesses, has created a disappointing result. This failure caught central bankers and the governments by surprise and revealed a fatal flaw in their support packages. At the heart of this misunderstanding is the fact that banks have already switched their business models to reflect a payment system that has been divided into two parts: wholesale and retail. Banks have changed the gear towards providing wholesale payment-those made between financial institutions (e.g., banks, pension funds, insurance companies) and/or large (often multinational) corporations- and away from retail payment. They are so taken with their new functions as dealers in the money market and originators of asset-backed securities in the modern market-based finance that their traditional role of being a financial intermediary has become a less important part of their activities. In other words, by design, small businesses could not get the aid money as banks are not willing to use their balance sheets to lend to these small enterprises anymore.

In this context, the broader access to central bank money by small businesses could create new opportunities for retail payments and the way the central bank maintains monetary and financial stability. Currently, households and (non-financial) companies are only able to use central bank money in the form of banknotes. Central bank digital currency (CBDC) would enable them to hold central bank money in electronic form and use it to make payments. This would increase the availability and utility of central bank money, allowing it to be used in a much more extensive range of situations than physical cash. Central bank money (whether cash, central bank reserves or potentially CBDC) plays a fundamental role in supporting monetary and financial stability by acting as a risk-free form of money that provides the ultimate means of settlement for all sterling payments in the economy. This means that the introduction of CBDC could enhance the way the central bank maintains monetary and financial stability by providing a new form of central bank money and new payment infrastructure. This could have a range of benefits, including strengthening the pass-through of monetary policy changes to the broader economy, especially to small businesses and other retail depositors, and increasing the resilience of the payment system.

This increased availability of central bank money is likely to lead to some substitution away from the forms of payment currently used by households and businesses (i.e., cash and bank deposits). If this substitution was extensive, it could reduce the reliance on commercial bank funding, and the level of credit that banks could provide as CBDC would automatically give access to central bank money to non-banks. This would potentially be useful in conducting an unconventional monetary policy. For example, the COVID-19 precipitated increased demand for dollars both domestically and internationally. Small businesses in the U.S. are increasingly looking for liquidity through programs such as the Paycheck Protection Program Liquidity Facility (PPPLF) so that those businesses can keep workers employed. In the global dollar funding market, central banks swap lines with the Fed sent dollars into other countries, but transferring those dollars to end-users would be even easier for central banks if they could bypass the commercial banking system.

Further, CBDC can be used as intraday liquidity by its holders, whereas liquidity-absorbing instruments cannot achieve the same, or can do so only imperfectly. At the moment, there is no other short-term money market instrument featuring the liquidity and creditworthiness of CBDC. The central bank would thus use its comparative advantage as a liquidity provider when issuing CBDC. The introduction of CBDC could also decrease liquidity risk because any agent could immediately settle obligations to pay with the highest form of money.

If individuals can hold current accounts with the central bank, why would anyone hold an account with high st commercial banks? Banks can still offer other services that a CBDC account may not provide (e.g., overdrafts, credit facilities, etc.). Moreover, the rates offered on deposits by banks would likely increase to retain customers. Consumer banking preferences tend to be sticky, so even with the availability of CBDC, people will probably trust the commercial banking system enough to keep deposits in their bank. However, in times of crisis, when people flee for the highest form of money (central bank money), “digital runs” on banks could cause problems. The central bank would likely have to increase lending to commercial banks or expand open market operations to sustain an adequate level of reserves. This would ultimately affect the size and composition of balance sheets for both central banks and commercial banks, and it would force central banks to take a more active role in the economy, for better or worse.

As part 1 pointed out, banks are already reluctant to play the traditional role of financial intermediary. The addition of CBDC would likely cause people to substitute away from bank deposits, further reducing the reliance on commercial banks as intermediaries. CBDC poses some risks (e.g., disintermediation, digital bank runs, cybersecurity), but it would offer some new channels through which to conduct unconventional monetary policy. For example, the interest paid on CBDC could put an effective floor on money market rates. Because CBDC is risk-free (i.e., at the top of the money hierarchy), it would be preferred to other short-term debt instruments unless the yields of these instruments increased. While less reliance on banks by small businesses would contract bank funding, banks would also have more balance sheet freedom to engage in “market-making” operations, improving market liquidity. More importantly, it creates a direct liquidity channel between the central banks, such as the Fed, and non-bank institutions such as small and medium enterprises. Because central banks need not be motivated by profit, they could pay interest on CBDC without imposing fees and minimum balance requirements that profit-seeking banks employ (in general, providing a payment system is unprofitable, so banks extort profit wherever possible). In a sense, CBDC would be the manifestation of money as a public good. Everyone would have ready access to a risk-free store of value, which is especially relevant in the uncertain economic times precipitated by the COVID-19.

Elham Saeidinezhad is lecturer in Economics at UCLA. Before joining the Economics Department at UCLA, she was a research economist in International Finance and Macroeconomics research group at Milken Institute, Santa Monica, where she investigated the post-crisis structural changes in the capital market as a result of macroprudential regulations. Before that, she was a postdoctoral fellow at INET, working closely with Prof. Perry Mehrling and studying his “Money View”. Elham obtained her Ph.D. from the University of Sheffield, UK, in empirical Macroeconomics in 2013. You may contact Elham via the Young Scholars Directory

Jack Krupinski is a student at UCLA, studying Mathematics and Economics. He is pursuing an actuarial associateship and is working to develop a statistical understanding of risk. Jack’s economic research interests involve using the “Money View” and empirical methods to analyze international finance and monetary policy.