In a speech showing no regard to Cuban’s historical sensitivities, Trump announced from Miami that he was “canceling the last administration’s completely one-sided deal with Cuba.” By that he meant reversing from Obama’s policy of engagement with Cuba to the old sanctions-based approach. The decision has been extensively criticized, from both the left and the right of the political spectrum, in Austrian-economics outlets and on Cuba’s socialist state media. Even some Republican members of Congress opposed and distanced themselves from this policy, and The American Conservative said Trump was reversing to a “failed,” “brain dead” policy which “will end up strengthening [Castro].”

The stated goal of the policy is to enforce compliance with the Embargo and the tourism ban, take a tougher stand on human rights abuses in the island, and to contribute to the economic, political empowerment of the Cuban people. Despite all the Cold War-style rhetoric in his speech, Trump is not actually “canceling” the whole deal with Cuba. According to the White House policy fact sheet, the embassies will remain open, maintaining diplomatic relations between the two countries, and Cuban-Americans’ travel and remittances are not impacted by the policy. As American University professor William LeoGrande recently put it, the plan is a “compromise between Cuban-American hard-liners’ demands that he reverse every aspect of Obama’s opening, and the pleas of U.S. businesses that he not shut them out of the Cuban market.”

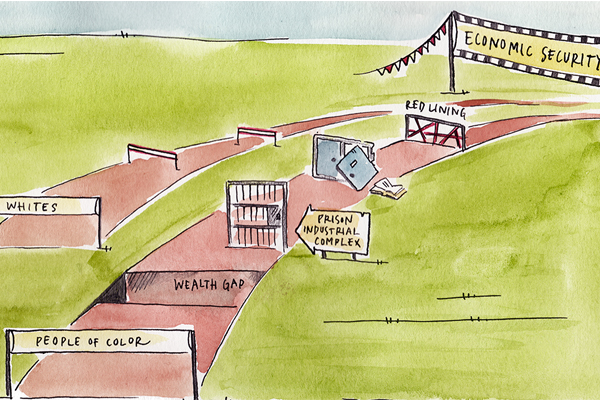

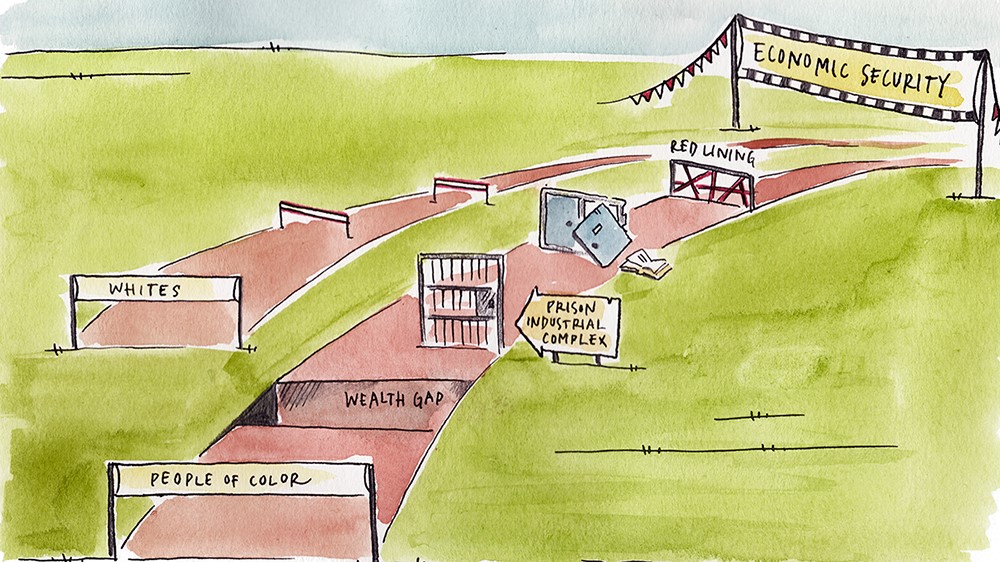

However, the new policy approach will not exactly economically empower the Cuban people, since Cuban private sector entrepreneurs will be hit the hardest by a key policy change—the enhancement of the travel ban for American citizens. While Americans can still travel to the island in groups through a licensed tour company, prohibiting travel under the individual people-to-people license is likely to reduce the number of American visitors—the same citizens that Paul Ryan once praised as “our best ambassadors” of democratic values—which will result in the opposite of the intended policy goal.

Cuban Entrepreneurs Will Take The Hit

The more immediate effects of Trump’s measures will hit Cuban private businesses in the tourism industry. A recent survey found American travelers are directly supporting Cuban entrepreneurs economically. According to the survey, 76 percent of American visitors stayed at casas particulares (privately-owned houses), 99 percent ate at privately-owned restaurants, 85 percent traveled in private taxis, and 86 percent bought art, crafts, or music from independent artists. As a result of a lower number of American visitors, we can expect Cuban Airbnb hosts—Cuba is Airbnb’s “fastest-growing country…with over 22,000 listings,” bar and restaurant owners and their employees, taxi drivers, etc. to see their incomes reduced. This hurts the very same people the policy claims to “empower.”

In the first half of 2017, Cuba received some 285,000 American visitors, an increase of 145 percent with respect to the same period in 2016. As a result of the enforcement of travel restrictions, the number of American visitors and the economic support they provide to the private sector could be greatly reduced. Cuban economist Pedro Monreal estimates direct losses to the Cuban private sector on the range of $14.7 to $20.8 million, in the second half of 2017 alone—and not including the spillover or multiplier effect that the private sector’s incomes may have in Cuba.

Additionally, the language in the regulations expands the definition of Cuban government officials ineligible to receive remittance payments from the U.S, which could potentially exclude a million Cubans from receiving remittances. These private transfers—typically to family members—are the lifeblood of the Cuban private sector economy, both as one of the main sources of funds for entrepreneurs to invest in their businesses and of income for national consumers. Thus, restricting these transfers will affect the standard of living of remittance recipients and also severely obstruct the development of a vibrant private sector on the island.

Cuba’s External Debt Commitments

Cuba has made efforts to renegotiate its outstanding external debt—on which the government defaulted in the 1980s—and to resume servicing its obligations in order to regain access to international finance. President Castro has already taken steps to improve the country’s creditworthiness by promising to honor the commitments resulting from agreements reached during the renegotiation of debt owed to other governments and private sector creditors. The most important agreement was with the Paris Club and its Group of Creditors of Cuba, in December 2015. The Group derogated the accumulated interests and brought down the total stock of debt from $11.1 billion to $2.6 billion—the original principal, to be paid over a period of 18 years. The first installment was already paid in October 2016, amounting to some $40 million. However, by depriving the Cuban government of foreign-currency income from the tourism industry, Trump might also be damaging the ability of the government to repay a debt owed to a number of U.S. ally countries. Moreover, damaging Cuba’s creditworthiness also affects the possibility of extending Cuba credits for the purchase of U.S. agricultural commodities, which is key to make U.S. exports more competitive vis-à-vis other foreign suppliers, and would provide the “greatest” boost to agricultural exports to Cuba.

Back to Cold War Politics amid Recession and Economic Reforms

The Cuban government had been implementing austerity for the past six years as part of a process to “update” Cuba’s economic system by reducing the role and size of the state in the economy. This process included tight controls over fiscal expenditures and massive layoffs from the state economy. For example, Cuban official statistics show that from 2010 to 2015, government employment was reduced at a rate of 117,000 jobs a year; removing around 585,600 jobs from the economy in that period. The assumption was that those workers would be absorbed by an expansion of the private and cooperative sectors—which indeed increased their ranks by 461,000 jobs, around 79 percent of the reduction in government employment. Thus, Trump’s measures will be affecting the most dynamic job-creator sector of the Cuban economy.

This comes at a time when Cuba is trying to shake off an economic recession from last year—when GDP contracted 0.9 percent—and is beginning to make payments to its international creditors for the first time in more than two decades. Thus, Trump’s measures do not only jeopardize the expansion and profitability of the private sector, it also threatens the economic and social development of the nation, in general, and, in particular, the ability of the leadership to successfully restructure and revitalize the economy so that it works for the many—while at the same time escaping a looming recessionary episode and fulfilling external debt commitments. All of which, again, will have a disproportionately negative effect on the Cuban people.

Cuba: Caught-up Between “Trumpian” Politics?

The decision to roll back the policy of engagement with Cuba once again shows Trump’s frequent inconsistencies. This policy is not about putting America first, as it hurts American companies doing business with Cuba and restricts the right of U.S. citizens to travel freely. It is not about human rights, as Trump deals with a number of countries with abysmal human rights records—e.g. Saudi Arabia, Turkey, Philippines. And, it is not about economically empowering the Cuban people, as they will be the first to feel the effects of a worsening economic environment, standing to lose some $21 million this year. Instead, this foreign policy seems to be all about American internal politics. About the vote Trump needed from Miami’s Rep. Mario Díaz-Balart for the healthcare bill to pass Congress. About renting Marco Rubio’s loyalty during the Senate Intelligence Committee’s hearing of former FBI Director Comey. And, it is about Trump’s crusade to destroy all of President Obama’s signature policies—whether it is climate change, health care, labor laws, or Cuba.